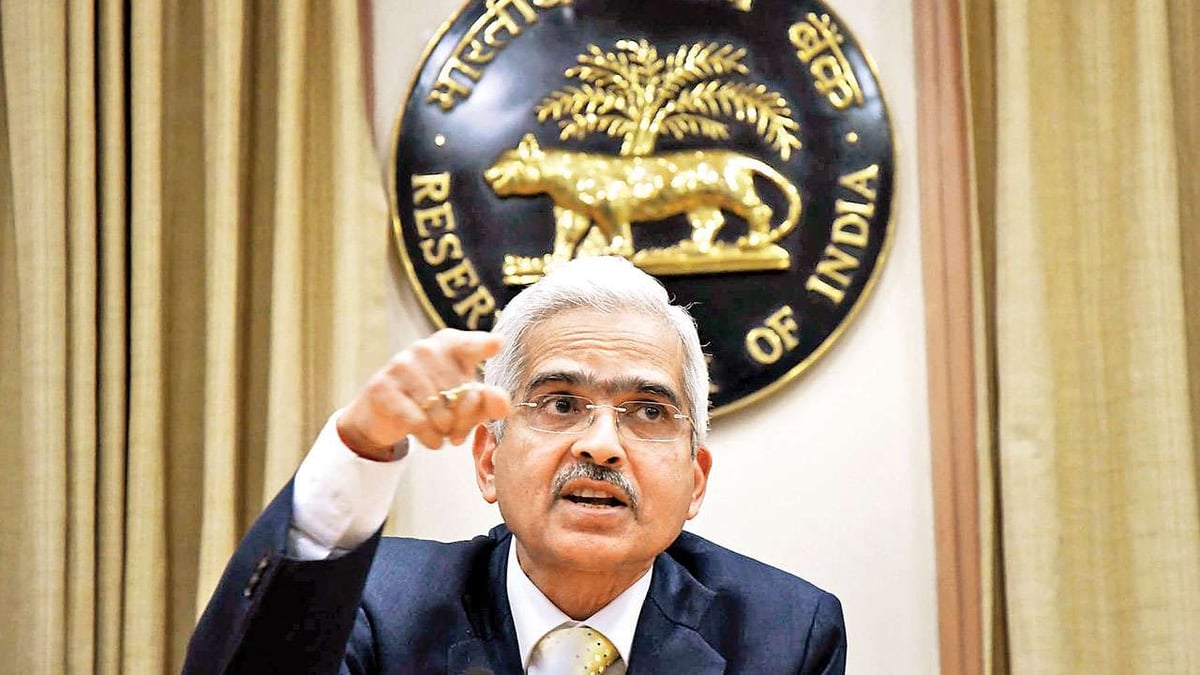

On Friday, December 6, the Reserve Bank of India once again retained its repo rate of 6.50 per cent, retaining the status quo. Governor Shaktikanta Das-led central bank has resorted to sustaining the same rate for the 12th straight time. This was announced by the government’s banker after a 3-day Monetary Policy Committee meeting that concluded on December 6.

The RBI Governor started his post-MPC speech with a great emphasis on maintaining price stability, along with maintaining and aiding growth.

Shaktikanta Das focused extensively on the pertinence of maintaining price stability. According to Das, this is crucial for most facets of the economy, including businesses.

RBI Maintains Repo Rate 6.50%

The governor started his address after the 52nd MPC meeting by remarking on the 8 years of the flexible inflation targeting framework.

This framework introduced in 2016, according to the governor, has assisted in bringing about stability in the economy, especially during the pandemic years.

The RBI has changed its GDP projection for 2024 to 6.6 per cent.

Why Has The Rate Been Retained?

This decision to retain the interest rate or repo rate comes at the back of major developments in the previous weeks.

The retail and wholesale inflation rate in the month of October saw a noticeable spike.

In fact the consumer price index/inflation rate surpassed RBI’s threshold of 4 per cent, jumping to a mammoth 6.2 per cent.

In addition, in what is seen as a double-whammy, India attained it’s slowest GDP growth rate in as many as 7 quarters. India’s GDP growth rate for the second quarter of the fiscal years (FY25) plummeted to 5.4 per cent.

The MPC Meeting

The MPC came to this decision with a 4-2 majority of the committee. The rate has remained at 6.50 per cent since February 2023.

The MSF or Marginal Standing facility, remained at 6.75 per cent. The SDF, or Standing Deposit Facility remained at 6.25 per cent.

This MPC meeting started on December 4 and concluded on December 6. These MPC meetings, under the leadership of the RBI governor (currently Shaktikanta Das), ruminate and decide upon the monetary policies for the country every two months. The next MPC is scheduled to happen in 2025.

A repo rate would inevitably result in higher loan interest rates, which would limit your ability to borrow money and the amount of money that is available to the market and the economy as a whole.The RBI governor is expected to hold a post-meeting presence press conference later on December 6 at around 12:00 IST.