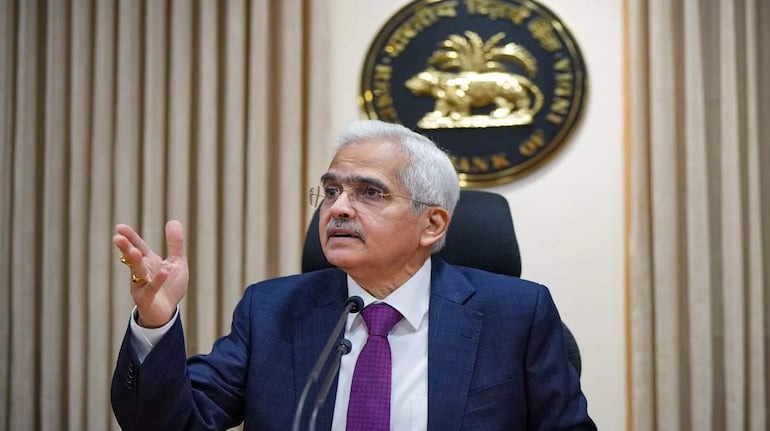

RBI Credit Policy: RBI Governor Shaktikanta Das has not made any change in interest rates for the 11th consecutive time. RBI has not made any change in repo rate, CRR rate. However, this was already being anticipated. RBI has decided to maintain the repo rate at 6.5 percent. The Monetary Policy Committee of RBI has also not changed its stance. RBI has now changed its stance to ‘neutral’. According to economists’ estimates, no change in rates is expected in the MPC meeting before the new financial year. 4 out of 6 MPC members are in favor of the decision. It clearly means that the vote was taken in favor of change in interest rates.

Repo rate is the rate at which the central bank of any country lends money to commercial banks. When banks are short of funds, they can borrow money from the central bank. Repo rate is imposed on this money. With the help of repo rate, MPC controls inflation. After this the repo rate is increased by RBI. Whereas they have to control inflation. At the same time, when there is a need to inject more money into the market and support economic growth, the repo rate is reduced.

RBI Governor has raised FY25 retail inflation forecast to 4.8% from 4.5%. With this, the CPI estimate for Q3FY25 has been increased from 4.8% to 5.7%. CPI estimate for Q4FY25 has been raised to 4.5% from 4.2%. With this, the CPI estimate for Q3FY25 has been increased from 4.8% to 5.7%. CPI estimate for Q4FY25 has been raised to 4.5% from 4.2%. CPI estimate for Q1FY26 has been raised to 4.6% from 4.3%.

Inflation reached 14-month high in October

In October, India’s retail inflation hit a 14-month high of 6.21 percent year-on-year. This increase was mainly driven by food inflation. Which reached the highest level of 15 months at 10.9 percent on year-on-year basis. In the food category, vegetable prices also witnessed a sharp rise. It reached a 57-month high of 42 percent year-on-year. Whereas tomatoes increased by 161 percent. There was an increase of 65 percent in potatoes and 52 percent in onions.

RBI’s focus on food inflation

This week, senior leaders including Chief Economic Advisor (CEA) V Ananth Nageswaran, Commerce Minister Piyush Goyal and Finance Minister Nirmala Sitharaman have called for reducing borrowing costs to support businesses. However, the Reserve Bank of India (RBI) has focused on food inflation as an important factor in its monetary policy decisions. The CE has suggested keeping food prices out of the inflation basket. The argument is that central banks cannot control such variables. However, RBI has not yet given any response to this proposal.

CRR for banks reduced from 4.5% to 4%

RBI Governor announced the policy to reduce CRR for banks from 4.5% to 4%. He said that now in the MPC meeting, the Cash Reserve Ratio (CRR) has been reduced by 0.50 percent. This will bring additional cash of Rs 1.16 lakh crore into the system.

Farmer loan limit increased to Rs 2 lakh

RBI Governor Shaktikanta Das said that the limit of collateral free loan for farmers has been increased. RBI has increased the farmer collateral free loan limit to Rs 2 lakh. This type of farmer loan limit has increased to Rs 2 lakh per borrower.