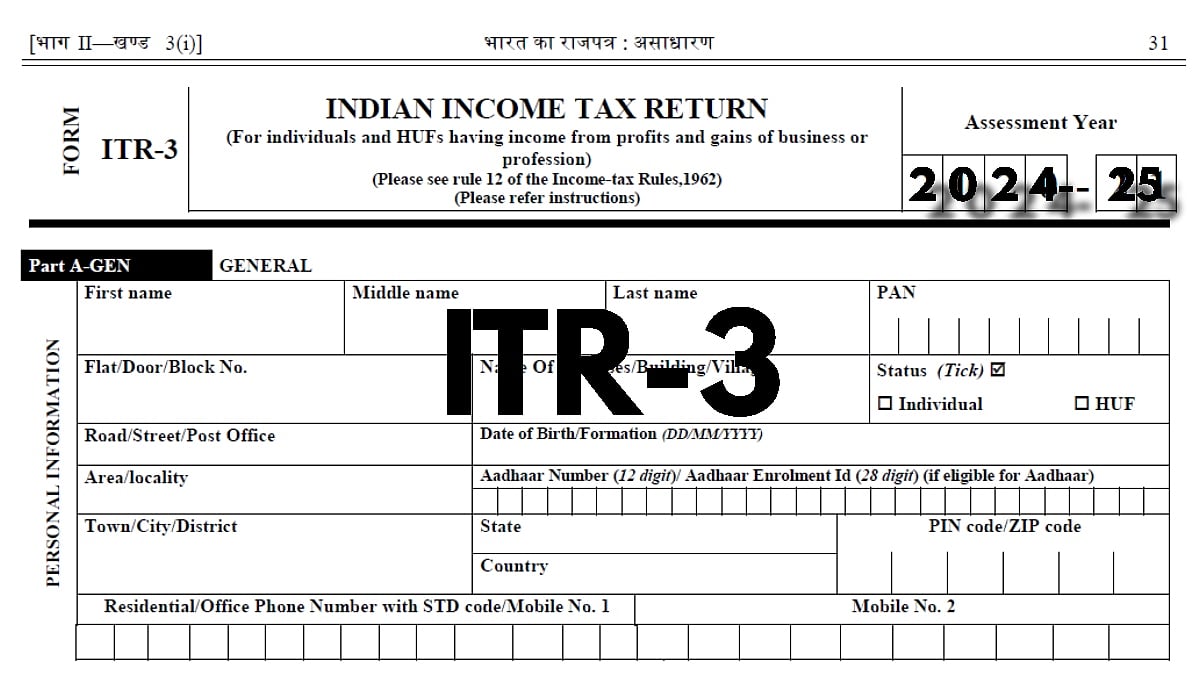

The Income Tax Department has issued the ITR-3 form for the Assessment Year 2024-25. This form is for individuals and Hindu Undivided Families (HUFs) who have income from business or profession.

Key Changes in the Form

Several new changes have been made in the revised ITR-3 form. These changes are in effect from April 1, 2025. They aim to make the tax filing process easier and more transparent.

Holding Period in Capital Gains

In the ‘Schedule CG’ section for capital gains, a new column has been added for the holding period of assets. This will help clearly report how long an asset was held before it was sold.

Section 50 – Short-Term Capital Gains

A new column is added to report short-term capital gains under Section 50. This section covers profits made from selling assets whose value goes down each year, like machinery or vehicles.

New Tax System is Default

From this year, the new tax system will be the default option. If you do not choose any option, this system will apply automatically. But if you want to follow the old tax system, you must file Form 10-IEA.

TDS on Business Income and Perks

Now, e-commerce operators must report 1 per cent TDS on total business income under Section 194Q. Also, businesses must provide TDS details on benefits and perks given to others under Section 194R.

Compulsory E-Filing for High Earners

Businesses with income above ₹5 crore must file their returns electronically. This rule is now compulsory.

Foreign Assets Must Be Reported

If you have any foreign income or assets, you must report them in Schedule FA. This will ensure transparency in cross-border transactions.

Help and Support Available

The Income Tax Department said that it will provide extra resources and guidance through its website in an easy-to-understand series.