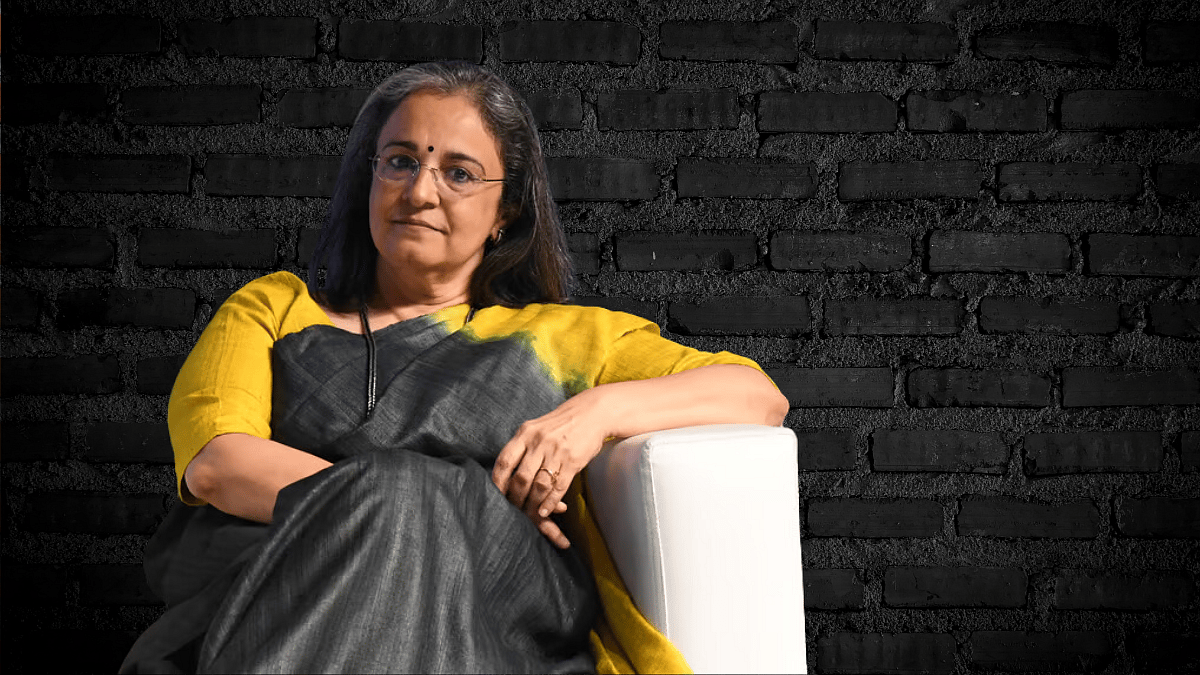

Madhabi Puri Buch will be serving her last day as the chairperson of the Securities Exchange Board of India on Friday, February 28. Buch served a three-year tenure from March 1, 2022 – February 28 2025. Finance Secretary Tuhin Kanta Panda has been appointed as the new chair of the market watchdog.

A Look Back

Buch’s tenure spanned three years, and many things came to pass in this time period, however, some elements that came to pass in the final laps of her tenure may remain in the larger memory of the market paradigm.

When we look back at her tenure, the first ever woman chief of SEBI took over as India and the world at large was coming out of a pandemic, and the markets were set to expand further, exploring summits.

Reforms Of Buch

It also needs to be noted that she was from the private sector and not a career bureaucrat.

It was during Buch’s tenure that the T+1 Settlement Cycle came to pass. During her stint, the SEBI transitioned the Indian stock markets to a T+1 settlement cycle in 2024. This transition mitigated the time needed for trade settlements and thereby increased the efficiency of the market.

The focus was also on technology, as Buch looked to professionalize and ‘technify’ the market regulator and other aspects of the market. | PTI

Regulations

Another major achievement of SEBI under Buch was with regulations, that tightened the system, thereby protecting investors and the market at large. Regulations were tightened in the sphere of Futures and Options or F&O trading. In addition, financial influencers, or Finfluencers, were also kept under the radar.

Regulations also looked into insider trading by expanding the definition of term ‘Insider’ in the context of the markets.

The SEBI also reformed IPOs by tightening norms around disclosure in IPO documents.

The focus was also on technology, as Buch looked to professionalize and ‘technify’ the market regulator and other aspects of the market.

To make SEBI a more technologically advanced regulator, Buch promoted the deployment of data analytics in surveillance and regulatory procedures.

The SEBI also reformed IPOs by tightening norms around disclosure in IPO documents.

|

Hindenburg Allegations

One of the biggest falls of her tenure came in the form of the second Hindenburg allegations, that saw the erstwhile research/short-seller group accuse Buch and her spouse Dhaval Buch of having vested interests in the matter of Adani Group.

This came to pass at a time, when the group was, and is under investigation of SEBI for violations of rules, that were first raised by the Hindenburg group.

The group accused Buch of having stake in offshore entities of Adani and thereby paved a way for conflict of interests.

The controversy led many to ask for her resignation. Buch had to come out and defend herself, as she denied any misdoing and conflict of interests.

The storm on the matter eventually passed; however, the mark of the day continues to remain, and lurk in the system.