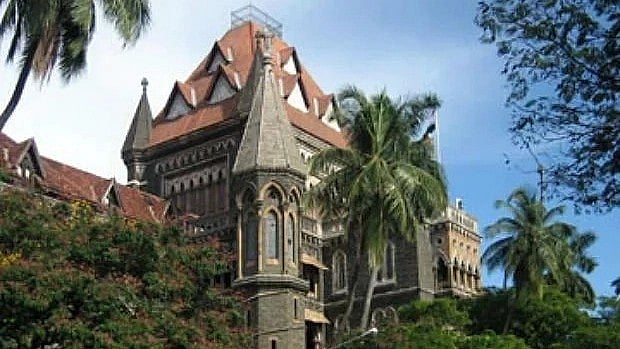

Mumbai: In a significant ruling, the Bombay High Court has held that compensation awarded to accident victims under the Motor Vehicles Act (MV Act) cannot be reduced by deducting amounts received under a mediclaim or medical insurance policy.

The ruling was passed by a three-judge bench of Justices AS Chandurkar, Milind Jadhav, and Gauri Godse that was constituted to resolve conflicting views on the issue.

The question before the bench was whether medical expenses reimbursed through a mediclaim policy should be deducted from compensation awarded under Section 166 of the MV Act. The court held that such deductions were impermissible, as the amount received under a mediclaim policy was due to a contractual agreement between the insured and the insurer, independent of the statutory compensation claim.

The New India Assurance Co. Ltd., represented by senior advocate Vineet Naik, argued that insurance contracts operate on the principle of indemnity, which prevents claimants from recovering the same loss from multiple sources. The insurer contended that allowing compensation for medical expenses already reimbursed would result in a “windfall” for claimants.

Countering this, advocate TJ Mendon, representing the claimant, emphasised that a mediclaim payout is a contractual benefit, whereas compensation under the MV Act is a statutory right. He cited Supreme Court judgments affirming that benefits from independent contractual arrangements cannot be deducted from compensation claims.

Advocate Gautam Ankhad who was appointed as amicus curiae (friend of the court), highlighted that the MV Act is welfare legislation designed to provide just compensation. He argued that permitting deductions would unjustly enrich insurers and penalise accident victims for prudent financial planning.

The judges said it was evident that the amount received on account of insurance is due to the contractual obligations entered into with the insurance company. Having paid premium it was clear that the beneficial amount would accrue to the share of the deceased either on maturity of the policy or on death, whatever be the manner of death.

“The tortfeasor cannot take advantage of the foresight and wise financial investments made by the deceased,” the court observed. A tortfeasor is a person or entity that commits a tort, a wrongful act that causes harm or loss to another person.

Referring to previous rulings, including one from the Calcutta High Court, the bench noted that mediclaim payouts represent a return on premiums paid by the insured. It rejected the idea that such benefits should be considered as “amounts received from other sources” while determining compensation.

“To consider such benefit as a benefit received from other sources would be a narrow-minded approach, not intended in the best interest of the victim,” the court said.

The court concluded: “Any amount received by a claimant under a mediclaim policy or under a medical insurance policy is not liable to be deducted from the amount of compensation payable to a claimant under the head ‘medical expenses’ in proceedings under Section 166 of the MV Act.”

The court emphasised that accident victims are entitled to full compensation under the MV Act, regardless of any independent insurance benefits they may receive.