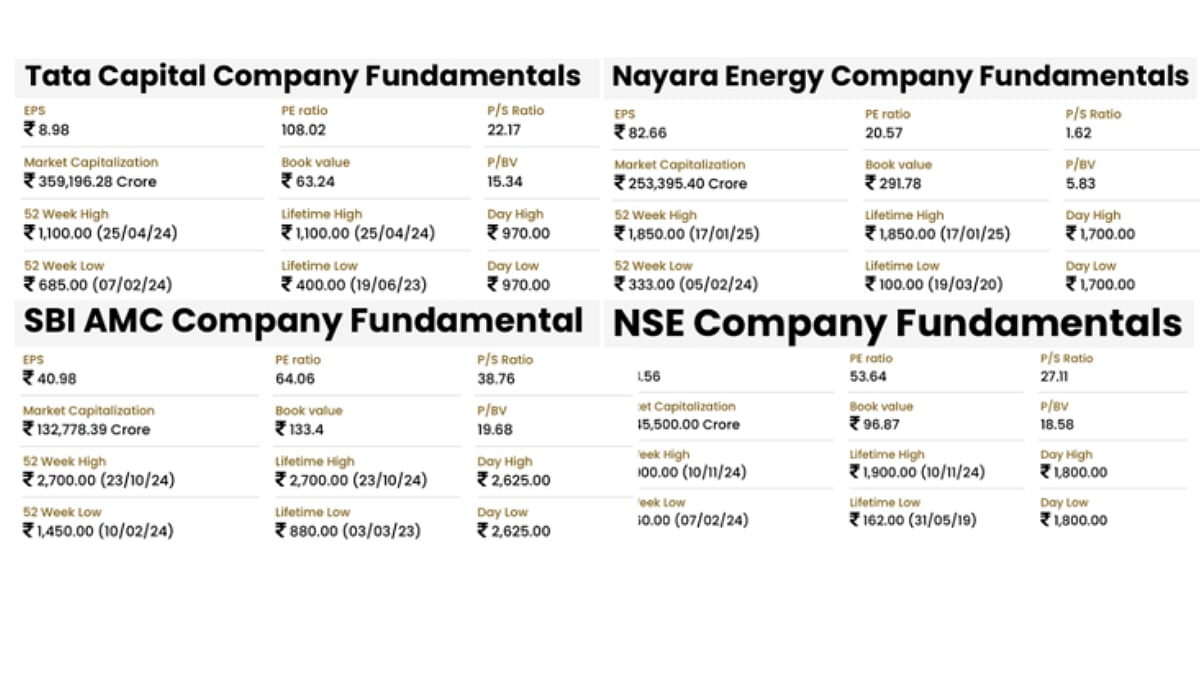

Key Company Performance Results. Source: https://wwipl.com | File Photo

The previous year was significant as it witnessed investors and shareholders of unlisted companies across various sectors delivering exceptional returns. Unlisted companies such as NSE, Tata Capital, SBI Funds Management, Nayara Energy, Motilal Oswal Home Finance, Cochin International Airport, Manjushree Technopack, Orbis Financial and MSEI experienced considerable growth in both price and trading activity.

The year also saw the high-profile listings of several companies previously in the unlisted market, which generated increased interest in other unlisted Companies. For example, Waaree Energies, whose unlisted share price was Rs 1,450 per share in January 2024, listed on exchanges in October at Rs 2500 and is now trading at around Rs 2,850 per share. Similarly, Swiggy’s unlisted share price was Rs 370 per share in January 2024 in Unlisted Market, and it was listed in November at Rs 420, and is now priced around Rs 550 per share.

From January 27 to February 3, 2025, some unlisted company shares reached their highest prices, which includes NSDL at ₹1,025 per share and PNB Finance & Industries Ltd. at ₹12,100 per share. This growth is significant, especially considering that in 2024, benchmark indices like the Sensex and Nifty registered gains of over 8 % each, while the BSE Midcap and BSE SmallCap indices surged by 26 % and 29 %, respectively.

The increase in unlisted stock returns can be attributed to higher demand and trading activity, with investors seeking superior returns compared to listed stocks. The active IPO market also played a vital role, encouraging investors to explore undervalued unlisted shares to maximize returns and minimize the risk of missing out on IPO allocations.

As the unlisted market continues to thrive, its appeal among investors is growing, driven by the opportunity to invest before public listings. Krishna Patwari, Founder and Managing Director of Wealth Wisdom India Pvt. Ltd. (WWIPL.com), shares insights on how to assess opportunities in the unlisted market through informed and careful decision-making.

Why Are Unlisted Shares Growing in Popularity?

Unlisted companies are not traded on the stock exchange and are instead available on the over-the-counter market. Transactions occur directly between buyers and sellers or through private markets.

Investing in unlisted companies offers investors:

● Access to firms in their early growth stages or those before going public.

● Exposure to high-growth sectors with significant return potential.

● The opportunity to diversify investment portfolios and reduce risks.

How to Invest in Unlisted Shares?

Direct Investment: Investors can directly contact unlisted companies to inquire about potential investment opportunities and buy unlisted shares. Thorough research on the company’s business model, financial health, management team, and future prospects should be conducted. Investment terms such as purchase price, valuation, and other relevant factors must also be discussed.

Investment in Startups and Pre-IPO Companies: Investments can be made in companies that are unlisted but intend to go public in the future, known as Pre-IPO companies. Upon investing, shares are transferred to the investor’s demat account, with transactions conducted outside formal stock exchanges. High-growth startups also offer opportunities for early-stage investments.

Purchase of ESOPs from Employees: Shares can be acquired through brokers or specialized platforms from employees selling their Employee Stock Ownership Plan (ESOP) shares. Typically, these shares are sold at a set price after the lock-in period. This method provides an alternative way to invest in unlisted shares of established companies.

Direct Purchase from Promoters: Significant investments can be made by purchasing shares directly from company promoters, who are usually the original founders or owners. Brokers or investment banks can facilitate these transactions. Wealth managers often assist in determining share prices and connecting investors with promoters for private placements. This approach may offer access to exclusive insider opportunities.

Investment through AIF and PMS: Alternative Investment Funds (AIF) and Portfolio Management Services (PMS) are managed portfolios where professional managers buy shares and sell them based on market trends. Unlisted shares are often included as part of these investment strategies. These options are generally safer, as portfolio managers handle challenges, manage risks, and adjust portfolios based on company performance and market conditions.

Investment Platforms for Unlisted Shares: Wealth Wisdom India Private Limited (WWIPL.com) offers investors access to exclusive opportunities in unlisted shares, Pre-IPO stocks, and the private market. The platform provides insights and guidance to help investors make informed decisions. One of its key offerings is the PRIMEX 40 Index, India’s first live private market index, which tracks the top 40 traded private market stocks and compares private and listed markets in India. The PRIMEX 40 delivers real-time data and covers a range of sectors in India’s private market. Wealth Wisdom India advises investors to conduct thorough research on unlisted companies and assess their growth potential before investing.

Key Factors to Consider Before Investing in Unlisted Shares

Krishna Patwari says, “Investing in unlisted shares requires careful evaluation of key aspects to assess valuation, growth potential, and expected returns.” He listed the following factors before investing:

Do’s:

● Identify companies with high growth potential, often early-stage businesses in innovative sectors that can become industry leaders.

● Check the company’s regulatory filings for IPO plans or public listing announcements to understand the timeline for going public.

● Examine financial statements, including profitability, cash flow, and asset health. Strong financials attract investors during IPOs.

● Assess the company’s market position and competitive advantage, as dominance in the market increases post-IPO success chances.

● Understand any lock-in periods that may restrict share sales, impacting exit options.

● Review past funding rounds and valuations to gauge the company’s valuation trajectory.

● Compare with peers in the same sector to assess fair pricing of the shares.

● Analyze financial performance metrics. Strong financials support higher valuations, while inconsistencies may indicate risks.

● Have a clear exit strategy, such as selling shares during an IPO, through an acquisition, secondary markets, or buybacks.

● Understand the risks associated with unlisted investments, including limited information and liquidity. Assess personal risk tolerance.

● Diversify investments across multiple unlisted companies to reduce risk.

● Consult a financial advisor experienced in unlisted investments for guidance.

Don’ts:

● Ignore liquidity; understand the challenges of selling shares in unlisted investments.

● Rely on hearsay; make decisions based on verified information, not rumors.

● Neglect legal formalities; always review investment documents and avoid relying on verbal agreements.

● Assume guaranteed returns; unlisted investments are inherently risky and may not offer quick profits.

● Fail to monitor; stay updated on the company’s progress and market conditions.

Investing in unlisted shares offers high rewards but also higher risks. Using this checklist—identifying promising companies, assessing IPO prospects, following top investors, ensuring liquidity, researching price history, and evaluating exit options—can improve success chances. With due diligence, unlisted shares can enhance a portfolio.

(Disclaimer: This is a syndicated feed. The article is not edited by the FPJ editorial team.)