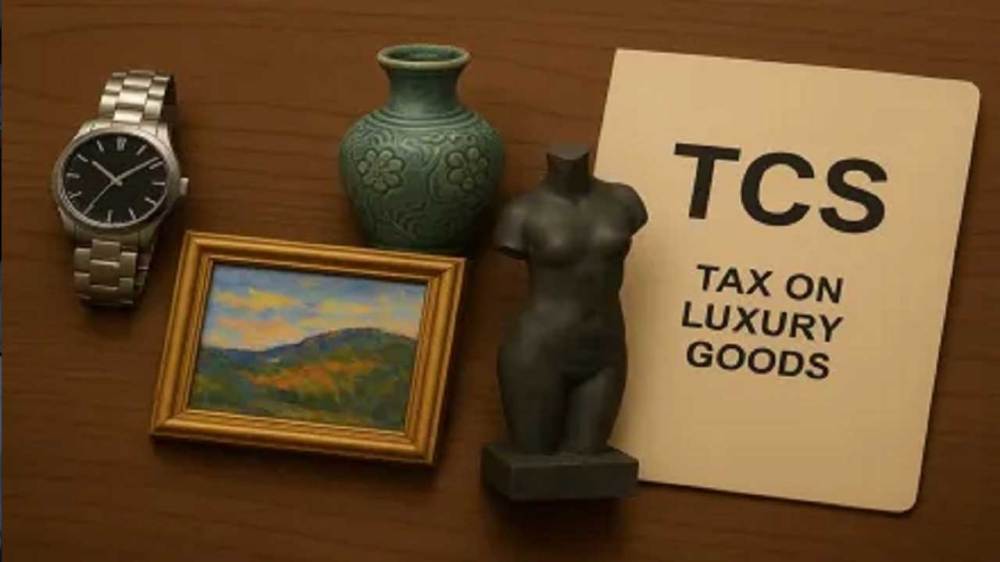

The Central Board of Direct Taxes (CBDT) has issued a notification for a tax collection of Rs 20 lakh. It has been announced that 1% tax deduction (TCS) will apply to the purchase of luxury goods worth more than Rs 10 lakh from 22 April 2025. According to the conditions of the advertisement, the items included in the list Rs. In cases where the purchase is worth more than Rs 10 lakh, the seller will be responsible for collecting TCS at the rate of 1 percent from the merchant buyer. This notification has been published under the Income Tax Act, 1962 under the Income Tax (Eleventh Amendment) Rules.

CBDT has issued a total of two notifications in this regard, one of which is about what kind of luxury items are included in it, while the other is about the rate of tax and the amount from which TCS will be imposed on the purchase of more. It is noteworthy that the announcement of TCS on the purchase of luxury goods was announced in the budget presented in July 2024. According to this announcement, this rule was to be implemented from 1 January 2025, but the notification related to it has not been published yet.

The Post Business: 1% TCS applicable from April 22 on the purchase of luxury goods worth more than Rs 10 lakh. First appeared on News India Live | Breaking India News, The Indian Headline, India Express News, Fast India News.