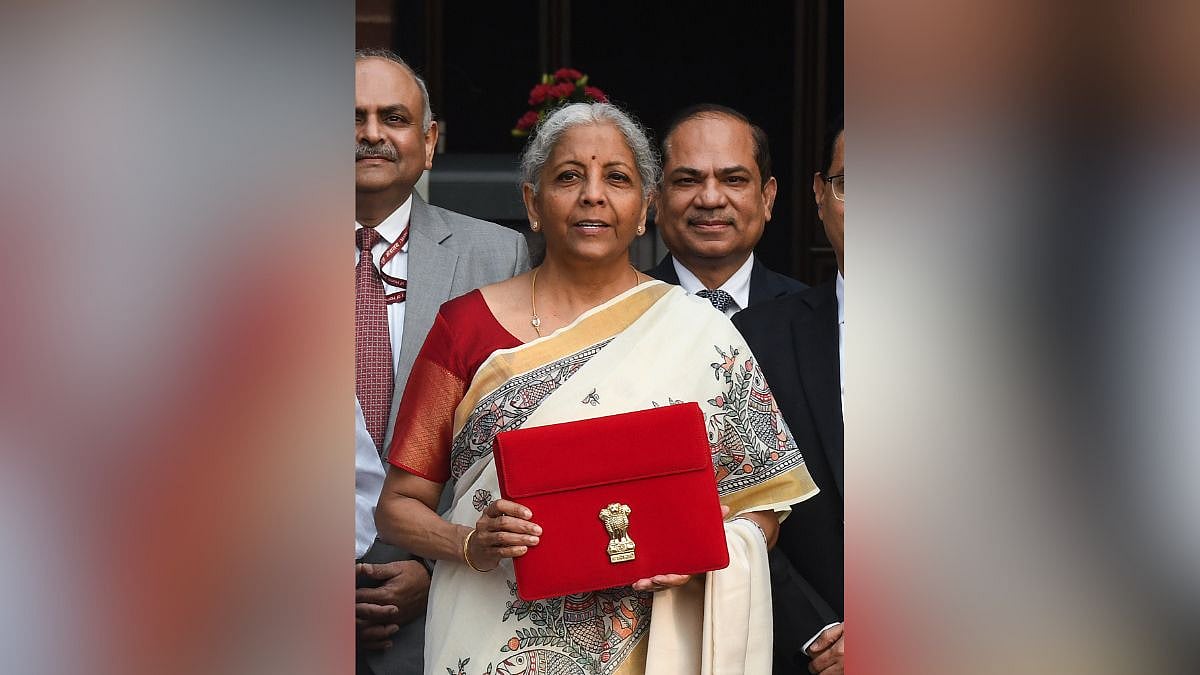

In real terms, the eighth Union Budget presented by Finance Minister Nirmala Sitharaman is a bonanza for the Indian middle class, but Non-Resident Indians (NRIs) remain disappointed.

The Indian diaspora was keen on the announcements in the Union budget presented by the finance minister. They are grossly disappointed as their expectations were not met with. NRIs are vital contributors to India’s economic development. As per the latest reports about, 35.4 million NRIs and people of Indian origins are residing outside India. Indian diaspora comprises the world’s largest overseas diaspora.

In 2024, India received an estimated $129.1 billion worth of remittances, the highest ever. NRIS were disappointed in the past few budgets as well due to the non-fulfilling of their certain genuine demands viz, investment-friendly reforms, simplified regulations, a comprehensive social security scheme under one umbrella for the migrant workers, participation in the popular small savings schemes of the government including investments in the sovereign gold bond scheme (SGBS), a solution for the excessive airfare during seasonal and festival times, etc.

On the other hand, the budget introduced stricter tax rules for NRIs including students and young professionals working abroad. Students working in the UK, US, Canada, Australia, etc., will face more reporting formalities and tax obligations and penalties for non-compliance. Undoubtedly, a more complicated financial future for NRIs, though this initiative is to align with global standards.

On the other hand, NRIs will also be benefitted out of the personal tax bonanza proposed to the residents, for their domestic income. The advantages in the enhanced basic exemption limit and the revised tax slabs are a big relief to them as well. While the reforms made in the tax laws to attract NRI investment included alignment of long-term capital gains rates with that of residents, reduction of the holding period for long-term assets, bonds, and investments from 36 months to 24 months, proposed presumptive taxation regime for certain foreign entities, changes in the liberalized remittances scheme (lLRS), etc. The persisting demands of the common NRIs, as mentioned above, were overlooked.

Outlook on Rupee

The Indian rupee will continue to be under pressure in the short run on account of the rates hold, a hawkish stand of the Fed and the US trade and tariff policies. Indian forex outflow is continuing and the budget disappointed the stock market as well. Despite the highest ever inward remittances of over USD 129 billion in 2024, the forex reserves declined from $704.90 billion in September 2024 to $624 billion, the lowest since March 2024.

The depreciation of INR is beneficial to the NRIs as well as exporters as they get more value for their earnings. The RBI review scheduled for next week will give directions on the rupee movements. Back in India, the budget 2025-26 will initiate reforms across the sectors and the focus is on accelerating domestic growth and fiscal consolidation.

The 100% FDI on insurance, containing the fiscal deficit to 4.4 per cent of GDP, the government’s commitment to doing ease of business, the urban reforms, increase in capex growth by 10 per cent, sops in agriculture, MSME, education sector, etc., are positives for the economy. Further, the measures proposed to boost the export sector will positively impact the trade deficit of the country.

While budget 2025 is a big win (bonanza) for the Indian middle class, their counterpart living abroad are not so. This vital segment has to wait further for a solution to their long pending demands, despite their support to the Indian economy by way of the highest global inward remittances.

R Madhusoodanan is a former senior SBI official and financial expert