Private lending giant Axis Bank shares were plummeting down more than 5 per cent after the bank declared their financials for the quarter ending December 31, which revealed, net profit slumped 8.8 per cent sequentially due to flat net interest income growth.

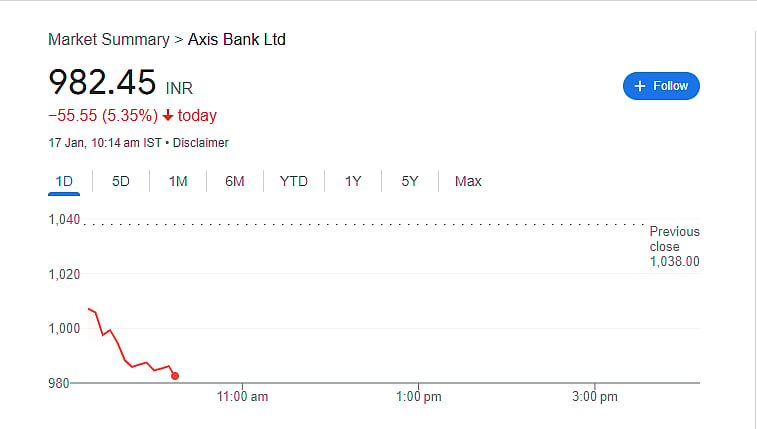

The shares of Axis Bank went on to touch the day low level of Rs 980.00 per share on the NSE (National Stock Exchange), after hitting opening bell at Rs 1,000.00 per share with a 3.36 per cent decline at the opening bell level.

Axis Bank shares were trading at Rs 982.45 per share on the Indian bourses with a downturn of 5.35 per cent amounting to Rs 55.55 per share on the dalal street.

Axis Bank Q3 FY25

In the third quarter of the current fiscal year 2024–2025, Axis Bank reported a 3.83 per cent increase in net profit to Rs 6,304 crore on January 16. Sequentially, the lender’s net profit decreased by 9 per cent. The net profit for the quarter ending in July and September was Rs 6917.57 crore.

Net interest income and margin

For the fiscal third quarter of 2025, Axis Bank generated interest income of Rs 30,954 crore, an 11 per cent increase over the Rs 27,961 crore reported during the same period last year.

In the quarter under review, the lender paid interest of Rs 17,348 crore, which was 12 per cent more than the Rs 15,429 crore paid in the Oct-Dec quarter of the previous fiscal year.

Exchange filling

Advances and deposites in Q3

The bank’s total advances increased 9 per cent year over year and 1 per cent quarter over quarter to Rs 10,14,564 crore, while its deposits increased 9 per cent year over year to Rs 1,095,882 crore. CASA deposits accounted for 39 per cent of total deposits.

Total deposits increased 13 per cent year over year and 3 per cent quarter over quarter on a QAB basis. Savings account deposits stayed unchanged year over year, current account deposits increased 11 per cent year over year, and term deposits increased 19 per cent year over year and 5 per cent quarter over quarter.

Gross and net NPA Q2 FY25

In comparison to Q2 FY25, when they were 1.44 per cent and 0.34 per cent, the GNPA and NNPA for the quarter were 1.46 per cent and 0.35 per cent for Q3 FY25.

The quarter’s gross non-performing assets were Rs 15,850 crore, slightly less than the Rs 15,893 crore of the previous year and compared to Rs 15,466 crore in Q2FY25.