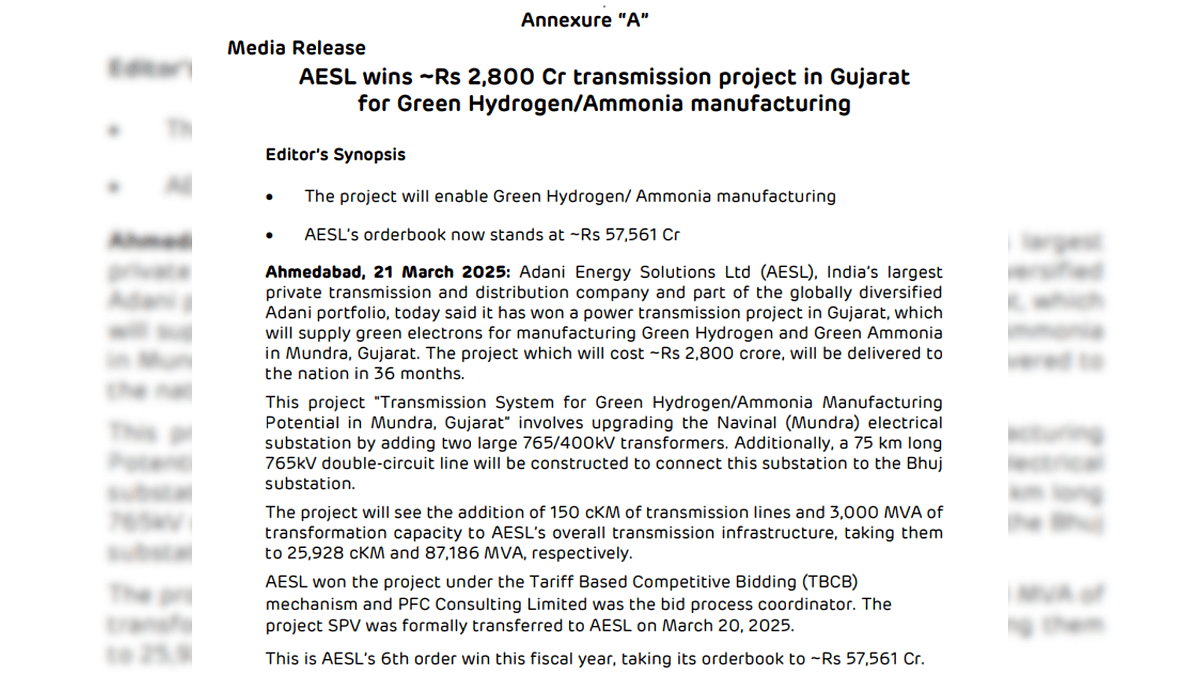

Adani Energy, one of the most pertinent names in the Adani Group portfolio recently announced that it has managed to bag Rs 2,800 crore energy transmission project in Gujarat.

Adani Energy Bags a Major Deal

The company announced this deal in an exchange filing.

This project will focus on green hydrogen/ammonia manufacturing. Furthermore, the project will supply green electrons for the manufacturing of the aforementioned green hydrogen/ammonia.

This mega project is expected to be delivered in 36 months or about 3 years.

This project involves the degradation of the Navinal (Mundra) electrical substation by adding two large 765/400kV transformers.

In addition to that the company will also be involved in the construction of a 75 km long 765kV double-circuit line to connect this substation to the Bhuj substation.

The project will see the addition of 150 cKM of transmission lines and 3,000 MVA of transformation capacity.

This is the Adani Group company’s 6th order win in FY25 or 2024-2025. This deal has taken the order book to Rs 57,561 crore.

Adani Energy Solutions Ltd Shares

When we take a look at the performance of the Adani Energy shares in the recent past, the company had a green-filled week with major gains, last week.

The company shares closed in green on the last day of trading. Adani Green Solution made gains of 1.83 per cent or Rs 14.90 on Friday, March 21 alone.

When we look at the larger picture, in the past week, thanks to the spurt witnessed in the larger equity markets, the company shares have zoomed significantly in value.

In the past week, as the Indian indices exhibited remarkable resilience, Adani Energy shares jumped 5.46 per cent or Rs 43.00. This surge over the past five trading sessions has taken the overall value of the company shares to Rs 830.00 per piece.

The company stock’s 52-week high stands at Rs 1,348.00 per share, while its 52-week low stands at Rs 588.00 per piece.