The Employees Provident Fund Organization (EPFO) has made some amazing changes for its crores of members in the year 2025, which will now do the work related to PF in minutes. These changes will not only provide facilities to the employees, but will also have a big impact on their hard earned money and pension matters. So if you are also a member of EPFO, then you must know these five major changes. Now say goodbye to the troubles of PF.

Updating profile is children’s game

Now it has become easier to make any kind of change in your profile in EPFO. If your universal account number (UAN) is link to your Aadhaar card, then you can update important information like your name, date of birth, gender, nationality, marriage name, matrimonial status, name of spouse and date of starting job without any paper.

However, members whose UAN is made before 1 October 2017 may have to take approval from their company in some cases. This revolutionary change will prove to be a milestone in saving the valuable time and hard work of the employees.

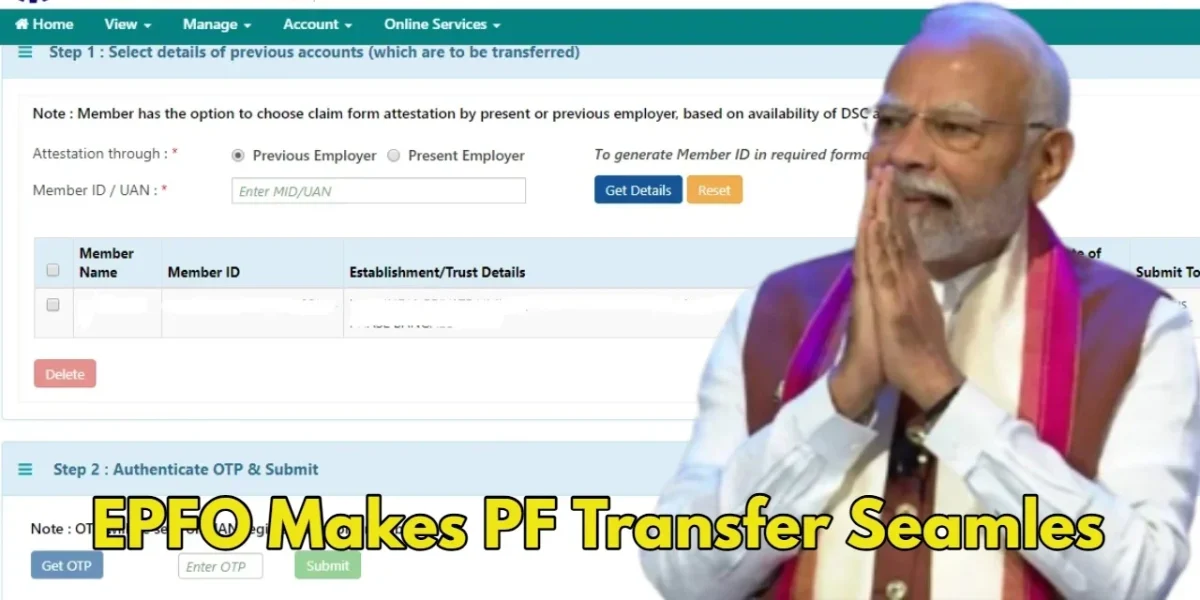

The hassle of the company’s approval is over

On changing the job, it was a difficult task to transfer PF money, which had difficulties of both the old company and the new company. But since 15 January 2025, EPFO has also made this difficult task easy. Now in most cases there will be no need to take approval from the old or new company.

If your UAN is link to Aadhaar and your personal information (name, date of birth, gender) is correct, then your PF money will be transferred in the blink of an eye. This change will help a lot in managing your savings and maintaining continuity.

Your pension is now directly into your bank account

EPFO has introduced a new system from 1 January 2025, Centralized Pension Payment System. Now your pension will come directly to your bank account, that too through a safe platform of NPCI. First, pension payment order (PPO) had to be sent from one regional office to another to send pension, which often delayed.

But now this mess is over forever. Apart from this, it has also been made mandatory to link the new PPO to UAN, which will also make it easier for our beloved pensioners to submit digital life certificates! This change has brought great relief to pensioners.

Direct rule of high pension on high salary

EPFO has cleared the pension rules for those employees who want to get pension according to their more salary. Now the same rule will apply to all in this case. If the salary of an employee is more than the fixed limit and he contributes more on his behalf, then he will be considered entitled to get pension on more salary.

Companies running private trusts will also have to follow these new rules of EPFO. This clear rule will prove to be a game-changer in increasing the pension amount for high-paying employees.

Improving mistakes is now easy

On 16 January 2025, EPFO issued new and easy guidelines to simplify the joint announcement (JD) process. Now if there is a mistake in your PF details or any information is incomplete, then it will be very easy to fix it.

This will make the claim process faster and transparent than before. These changes will make EPFO’s services even better and convenient for employees and pensioners. Now you do not have to worry about even small work related to PF.