Tensions with Pakistan, inflation data, and key corporate results to drive investor sentiment. |

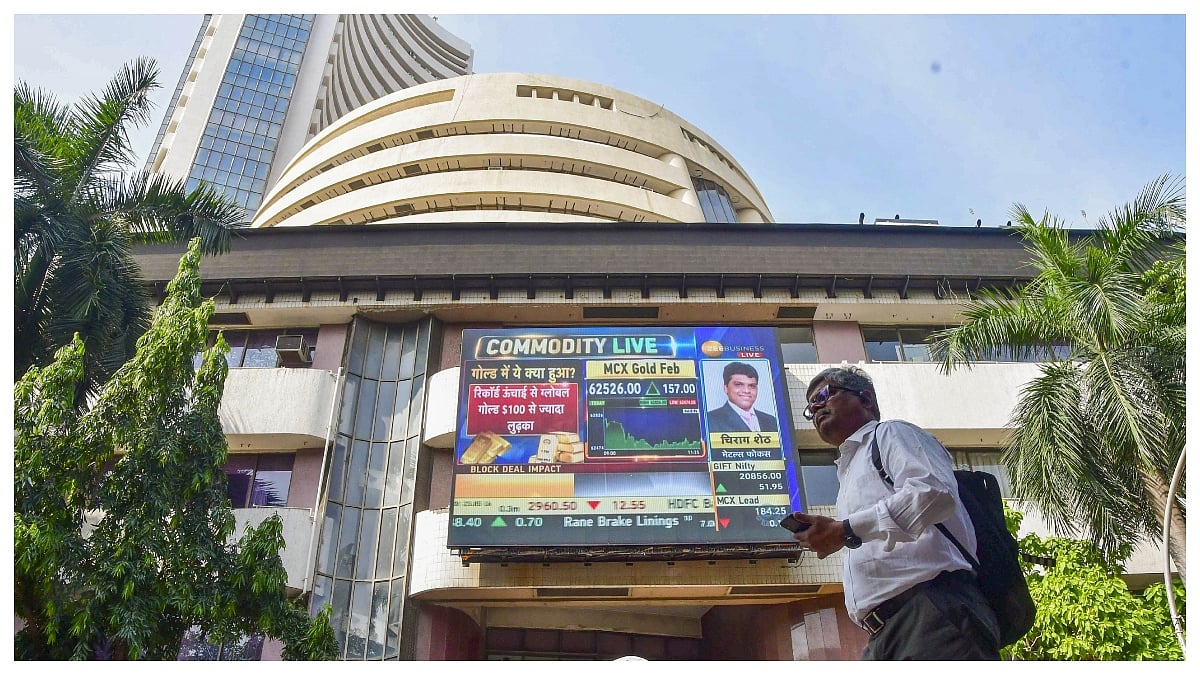

Mumbai: The Indian stock markets are poised for a turbulent week starting May 13, 2025, as a confluence of geopolitical tensions, macroeconomic data releases, and corporate earnings announcements is expected to influence investor sentiment. Market experts say that with heightened border tensions, especially the ongoing standoff with Pakistan, traders will remain cautious, even as crucial economic indicators and Q4 earnings shape market direction.

Ajit Mishra, SVP – Research at Religare Broking Ltd, noted that the upcoming week will be pivotal for the markets. “Geopolitical developments, particularly the ongoing tensions with Pakistan, will continue to remain in focus,” Mishra said. These tensions have already rattled markets, following reports of drone and missile attacks leading to heightened fears of escalation.

On the economic front, investors will closely track the release of India’s Consumer Price Index (CPI), Wholesale Price Index (WPI), and trade data. The CPI YoY data, due on May 13, is expected to offer insights into inflation trends, crucial for gauging the Reserve Bank of India’s future policy actions. On May 15, exports data will also provide an update on India’s external trade performance amid global economic uncertainty.

Adding to the action-packed week, the earnings season will see several large-cap companies declaring results, including Tata Steel, PVR INOX, Bharti Airtel, Cipla, GAIL, Hero MotoCorp, Tata Motors, Lupin, BHEL, and Godrej Industries. These results are likely to trigger stock-specific movements and sectoral rotations.

The past week saw significant volatility, with both the Nifty 50 and BSE Sensex ending lower by 1.39 per cent and 1.30 per cent, respectively. The losses were primarily attributed to geopolitical tensions. The sell-off intensified on the final trading day after the Indian Army reported multiple overnight drone and munition attacks by Pakistani forces.

Sector-wise, Realty, Banking, Pharma, and Financial Services stocks recorded steep declines, falling between 2 per cent and 6 per cent, while Auto and Media showed relative resilience. Broader markets weren’t spared either, with mid- and small-cap indices declining up to 2.17 per cent.

The India VIX, a gauge of market volatility, spiked notably, signaling elevated risk perception among investors. With domestic and global uncertainties looming large, the upcoming week is expected to remain choppy.

(With ANI Inputs)