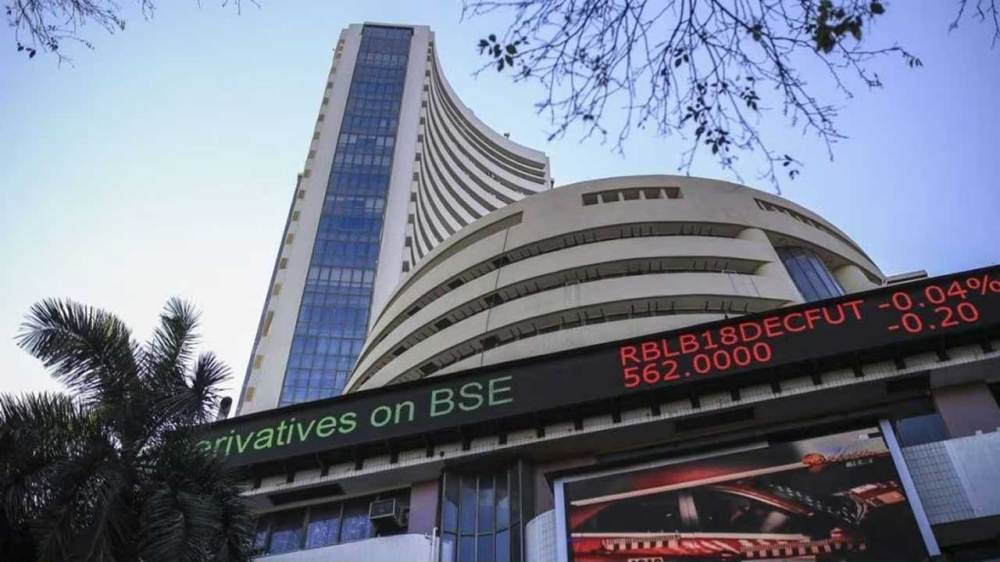

As a good sign for the Indian stock market, FII today invested Rs 1,000 crore. 6,065 crore rupees, while DII changed its stand to Rs. A net sale of Rs 1,951 crore was done.

With this, the net selling figure by FII declined to Rs 1,250 crore in April. 28,576 crore rupees, while Pignificant Acquisition by DII is Rs. 25,637 crores The last time FII made pure purchases on 27 March. The net investment of FII on that day was Rs 1,000 crore. 11,111 crores Thus, after 7 sessions i.e. a total of 18 days, FII has again made net purchases. The FII made net purchases in 6 consecutive sessions from 20 to 27 March, resulting in a net profit of Rs 1,000 crore. This month FII was a net buyer and made a net purchase of Rs 2014 crore.

All 14 regional index on Nifty closed with edge

Today all 14 sectoral index on Nifty rose from 0.28 per cent to 5.64 per cent. In the index, which saw a major decline in the stock market on 7 April after the US tariff was implemented, a significant increase was seen today. The most affected shares in the US include IT, metal, pharma and auto, with field indices 1.63 percent, 3.20 percent, 2.20 percent and 3.39 percent respectively. Despite the good indication of interest rate cuts by the RBI, banking and financial shares were seen to fall due to tariff pressure that day, while today Nifty Bank stopped 2.70 percent, private banks 2.82 percent, PSU bank 1.57 percent and financial services 2.95 percent. The realty index recorded the highest growth of 5.64 percent today, while the media index also closed 2.97 percent.

The Post Business: FII became a pure buyer after 18 days, net purchases of Rs 1.50 crore 6.065 crore first appeared on News India Live | Breaking India News, The Indian Headline, India Express News, Fast India News.