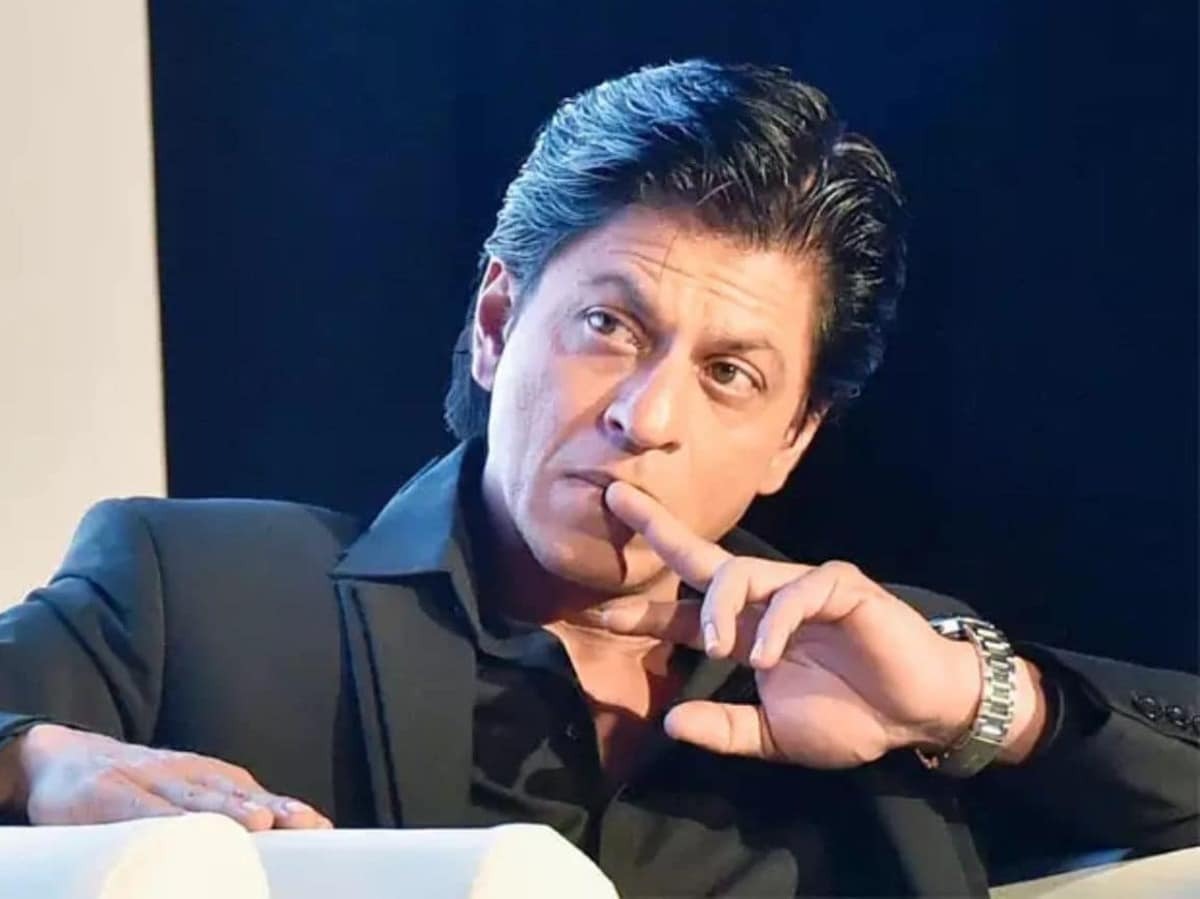

Bollywood superstar Shah Rukh Khan has won a major legal victory against the Income Tax Department. The Tax Appellate Tribunal (ITAT), while giving a verdict in his favor, termed the revaluation process of the Income Tax Department as illegal.

The case was related to the tax controversy related to his film ‘Ra.One’ released in 2011. The Income Tax Department challenged Shah Rukh Khan’s declared income (₹ 83.42 crore) and refused to recognize the tax paid in his United Kingdom (UK) as a foreign tax credit (FTC).

What was the whole matter?

- 70% of the film ‘Ra.One’ was shot in Britain, causing a large part of Shah Rukh’s income to be taxable under the UK tax system.

- The Income Tax Department rejected his claim of foreign tax credit and after four years, his taxable income increased to ₹ 84.17 crore.

- Shah Rukh was also accused of tax evasion and the department demanded a re -evaluation of his income tax.

Gujaratis dominated the cricket field! After winning, Hardik, Akshar and Jadeja took photographs sitting on the field

Why did ITAT reject the Income Tax Department’s arguments?

Tax Appellate Tribunal (ITAT) while giving a verdict in favor of Shahrukh said that:

The Income Tax Department had already conducted a thorough investigation, so the process of revaluation was illegal.

The department could not present any concrete new evidence, so that the need for re -examination could be proved.

This case of revaluation was against Indian laws.

After this decision, Shah Rukh Khan has got a big relief in tax related matters and this is an important moment of legal victory for him.

Talking about Shahrukh Khan’s work front…

- Recently Shah Rukh attended the IIFA Awards in Jaipur.

- He will soon start shooting for the film ‘King’ with daughter Suhana Khan.

- For the first time, this pair of father and daughter will be seen together on the big screen.

This decision has proved to be a major victory for Shahrukh on both personal and professional fronts.