Kaynes Technoloogies India’s shares dropped off a cliff; shedding almost 20 per cent in trading session, after company management cut back revenue guidance to Rs 2,800 crore for FY25.

The shares of Kaynes technologies went on to touch the day low of Rs 4,214.45 per share on exchanges after hitting the opening bell at Rs 4,851.00 per share with a decline of 15.10 per cent compared to closing bell level of Rs 5,268.05

Kaynes Technologies India’s shares were trading at Rs 4,256.80 per share with a decline of a whopping 19.20 per cent amounting to a Rs 1,011.25 per share on the Indian exchanges.

Kaynes Technologies Q3 FY25

Q3 FY25 revenue and net profit

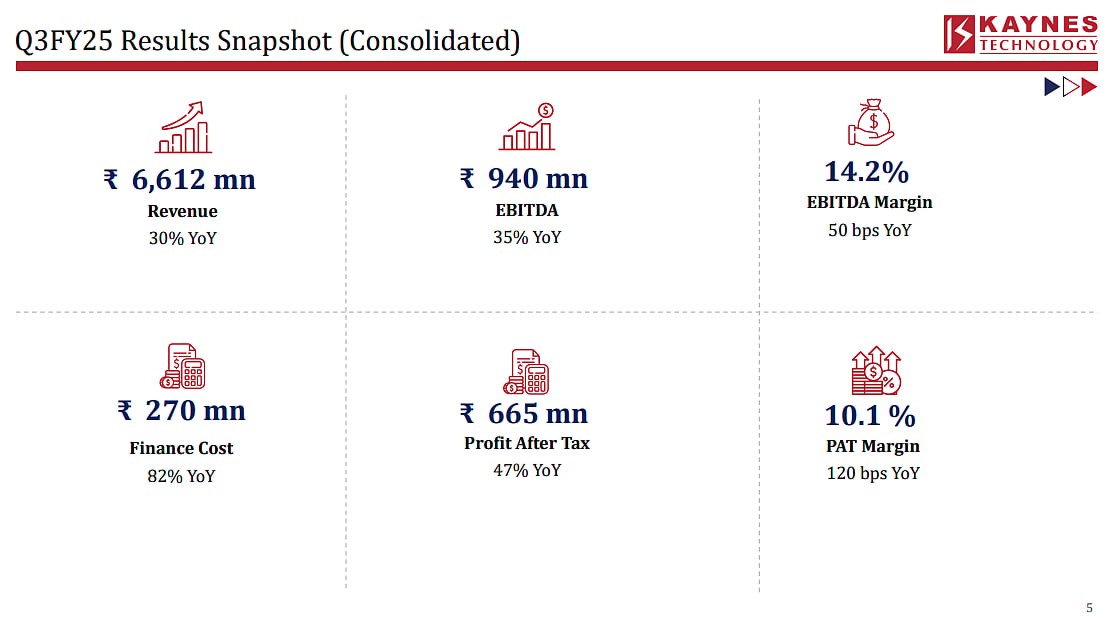

Kaynes Tech’s revenue increased by 30 per cent, but it fell short of analysts’ expectations. The company’s net profit rose 47 per cent over the previous year, but this was due to an increase in other revenue. With a margin of 14.2 per cent, the business met analyst expectations.

Compared to Rs 509.2 crore during the same period of the previous fiscal year, revenue from operations climbed 29.8 per cent to Rs 661.1 crore.

EBITDA Q3 FY25

In the meantime, the company’s EBITDA margin (earnings before interest, tax, depreciation, and amortization) was 14.2 per cent for the quarter, down from 13.7 per cent in Q3 FY24.

The margin was 14.0 per cent for 9M FY25. At Rs 66.50 crore, the company’s profit after tax (PAT) increased by 47.1 per centyear over year and by 10.5 per cent quarter over quarter. The company reported a 74 per cent YoY increase in PAT for 9M FY25, reaching Rs 177.4 crore.

Additional revenue generation

In the meantime, Kaynes’s recent acquisition of Iskramaeco India Private Limited (IIPL) and its planned capital expenditures for printed circuit board (PCB) and outsourced semiconductor assembly and test (OSAT) projects are anticipated to generate additional revenue streams.