2025 is expected to see a sharp increase in initial public offerings (IPOs), following the pattern of the previous year. A report estimates that nearly Rs 1.8 lakh crore worth of public issues are currently awaiting approval from the Indian market watchdog; the Securities and Exchange Board of India (SEBI).

The IPO pipeline this year comprises 28 companies with an aim of raising Rs 46,000 crore, according to the data from Prime Database. In addition, over 80 companies are waiting for SEBI’s approval in order to raise Rs 1.32 lakh crore.

SME IPO boom

Small and medium-sized businesses (SMEs) saw a spectacular surge in initial public offerings (IPOs) last year, raising Rs 8,761 crore in total—an 87 per cent increase over 2023.

Additionally, the average size of a SME issue has grown to Rs 36 crore, a six-fold increase.Compared to just 297 applications in 2020, retail investor participation in these SME issues increased significantly to 1.88 lakh applications.

Total funds raised in 2024

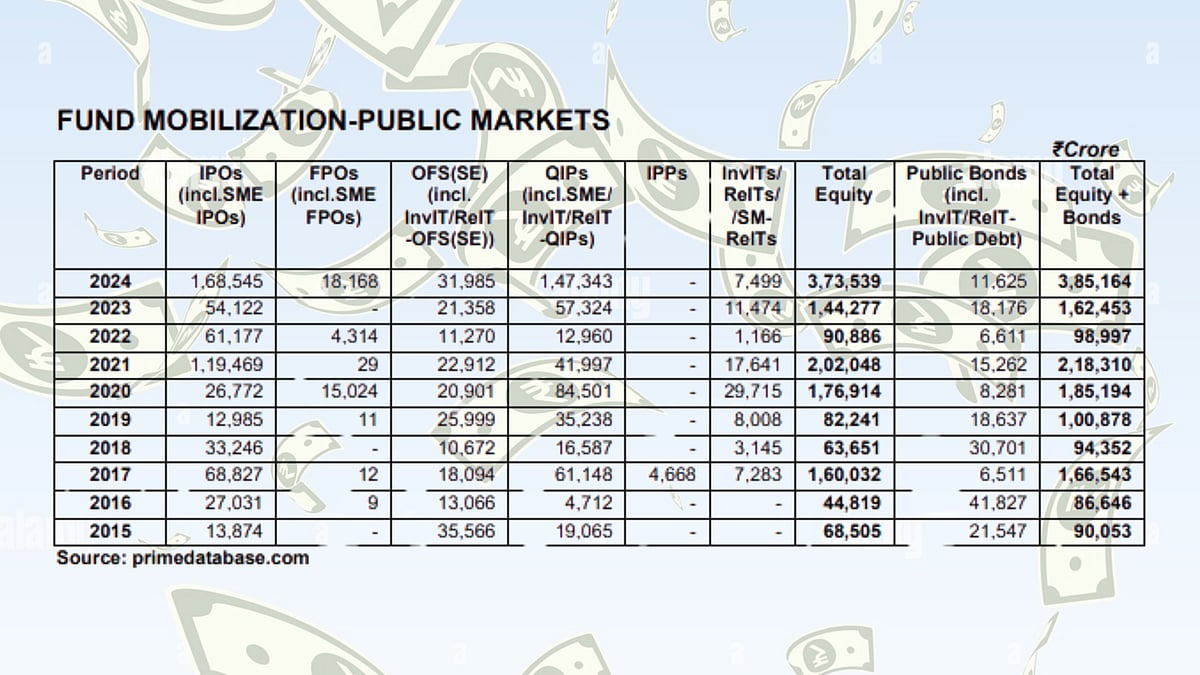

In 2024, 99 companies raised Rs 1.38 lakh crore through Qualified Institutional Placement (QIP), resulting in a 3 fold increase in mobilisation. Zomato and Vedantu raised Rs 8,500 crore apiece, making them the biggest QIPs of 2024.

In 2024, 91 companies raised Rs 1.6 lakh crore through mainboard initial public offerings (IPOs), which is a threefold increase from the 57 IPOs that raised Rs 49,436 crore in 2023.

Last year saw the IPOs of numerous new businesses, such as Swiggy, Mobikwik, Firstcry, and Awfis.

Fresh capital raised through public issues

40 per cent of the total funds raised last year, amounting to a Rs 64,499 crore, came from new capital raised through public offerings.

The retail category saw bids totaling Rs 3.4 lakh crore, 113 per cent more than the total IPO mobilization, and 66 of the 91 IPOs in 2024 were subscribed more than ten times.

Upcoming IPOs by high profile companies

Data by the Prime Database showed further that as of January 9, 65 out of 91 IPOs in 2024 were trading above their issue price, with the overall average gain from these 91 issues exceeding 44 per cent.

To top it off, as many as 20 new-age companies are expected to launch their IPOs in 2025 including Zepto, PhysicsWallah, Cardekho, Ecom Express, BoAt, Ather Energy and Avanse Financial Services.