Following a steep decline last week, the majority of U.S. stocks saw a slight increase on Monday.

Previous week has seen a steep decline after rally triggered by the optimism brought on by Donald Trump’s victory in US presidential election. All marquee indices went into an overdrive and went on to touch the record-breaking all-time high levels more than once after the US presidential election concluded.

The S&P 500

For the first gain in three days, the S&P 500 increased by 0.4 per cent. The Trump effect faded after a stellar move in S&P 500. On Monday, the broad market index went on to touch the day-high level of 5,908.12 points after hitting the opening bell at 5,874.17 points.

The opening bell was rung with an indecisive opening on the bell. In the first hours of trading, the index was hovering closer to the closing bell of the previous trading session, which stood at 5,870.62 points. On Monday, The concluded on 5,893.62 points with a surge of 0.39 per cent amounting to 23.00 points on the US bourse.

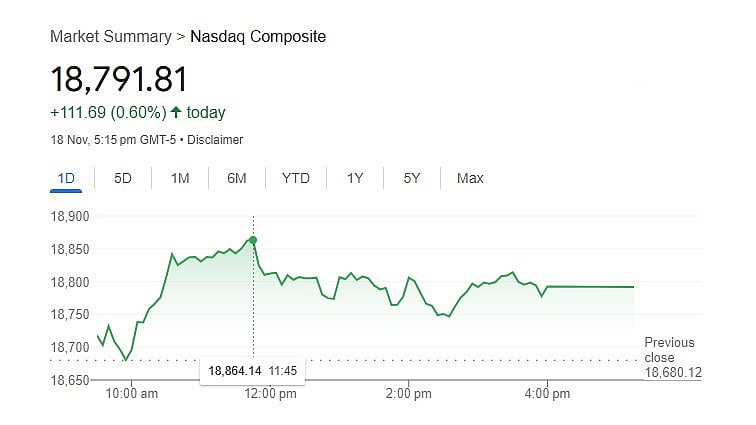

Nasdaq Composite

The index of the tech titans, including the biggest beneficiaries of AI and chip manufacturing Nvidia, Smartphone giant Apple, along with tech comp.es of magnificent seven pack, Nasdaq composite was biggest gainer in the trump effect, The entire tech pack was shaken around, which led them to zoom to new record levels more than once; later, the same rally subsided after the Trump effect faded out.

The Nasdaq composite went on to touch the day high level of 18,865.28 after hitting the opening bell at 18,717.93 points, close to previous trading session’s closing bell, which stood at 18,680.12 points. The eventually concluded at 18,791.81 points with a gain of 0.60 per cent amounting to 111.69 points.

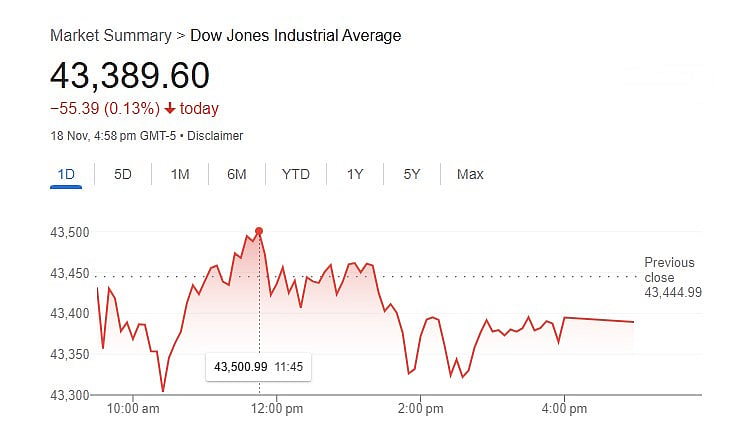

Dow Jones Industrial Average

The oldest index of the US securities market, Dow Jones Industrial Average, was an exception to the recovery that was seen everywhere else in the US stock market. Dow Jones went on to touch the day high level of 43,505.66 points after hitting the opening bell at 43,431.89 points in the negative trading zone compared to the closing bell level of the previous trading session, which stood at 43,444.99 points.

The Dow Jones Industrial Average concluded the trading session at 43,389.60 points, with 0.13 per cent decline amounting to 55.39 points, after trying ride the recovery rally seen in the other marquee indices of the US bourses.

The rally with Trump effect

After losing over half of their postelection gains at the end of last week, stocks started to gain some traction again. In the days immediately following Trump’s victory, investors had driven the S&P 500 up by almost 4 per cent.

Smaller businesses, bank stocks, and other market segments that were thought to benefit the most from Trump’s inclination for higher tariffs, lower tax rates, and less regulation performed especially well.

Treasury yields putting pressure on Federal Reserve

Treasury yields have also increased in the bond market due to concerns about possibly higher inflation under Trump. That might put the Fed in a difficult position as it attempts to reduce interest rates in order to loosen economic restraints and maintain a healthy labour market.