Cheap Gold Loan: Lending banks charge a low interest rate on gold loans. Because these loans are more secured than unsecured loans. The lender verifies the weight and purity of the gold before disbursing the loan amount.

The reason behind the popularity of gold loan is that many gold loan banks do not consider the credit score of the applicant. In such a situation, if your credit score is not good, then you can get a gold loan of more than Rs 1,50,00,000.

Gold loan borrowers must be aware of other charges that banks charge while availing a gold loan. Loan processing fee, appraisal fee, prematurity fee, installment late fee etc. are some of the charges that your bank may levy.

convertible into gold

The amount varies from bank to bank. The minimum loan amount in SBI is Rs 20,000 and the maximum amount is Rs 50,00,000. Whereas, Kotak Mahindra Bank customers can avail a gold loan of minimum Rs 20,000 and maximum Rs 1,50,00,000.

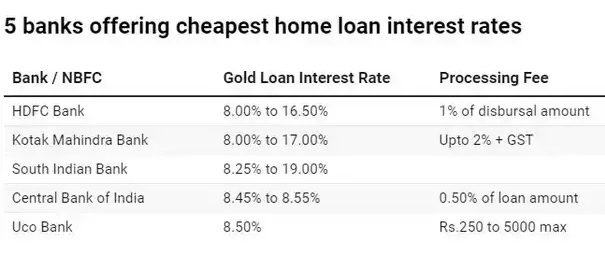

5 Banks that offer Gold Loan at affordable rates

Gold Loan Repayment Tenure

- According to the SBI website, gold loan customers are given 5 tenures for repayment.

- 36 months tenure for Gold Loan (EMI based) repayment.

- 36 months tenure for liquid gold loan (overdraft) repayment.

- Bullet period of 3 months to repay the gold loan.

- Bullet facility of 6 months to repay the gold loan.

- Bullet facility of 12 months to repay the gold loan.